Washtenaw County's taxable value sees positive gain for the first time since 2008

Washtenaw County’s overall taxable value increased in 2013 for the first time since 2008, marking the best gain in taxable value out of its adjacent counties this year, according to the county’s Equalization Department.

Since the economy slumped in 2008, taxable property values have declined in Washtenaw County. From 2012 to 2013, they increased by 1.68 percent to $14.2 billion.

While Washtenaw County's overall taxable value has increased for the first time since 2008, there are a number of limiting factors, including the declining property value of industrial facilities like the former GM Willow Run plant pictured here in March in Ypsilanti township.

Daniel Brenner I AnnArbor.com file photo

The figures were among an annual data set presented to the Washtenaw County Board of Commissioners for approval Wednesday night by Raman Patel, director of the Equalization Department. Patel has been compiling equalization reports for the county for 42 years.

The board approved the county equalization report in a 8-0 vote. Commissioner Rolland Sizemore Jr., D-Ypsilanti Township, was absent.

Patel also presented the board with a list of tentative taxable value changes for counties adjacent to Washtenaw:

- Wayne County: -1.20 percent

- Genesee County: -2.43 percent

- Oakland County: 0.00 percent

- Macomb County: -0.55 percent

- Livingston County: 1.18 percent

- St. Clair County: -0.06 percent

- Monroe County: -0.46 percent

- Lapeer County: 0.05 percent

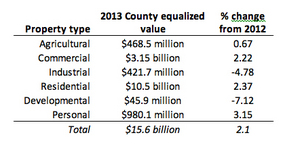

As residential property values stabilized and improved by 2.37 percent in Washtenaw County, industrial property values continue to decline.

Washtenaw County equalized values by type of property for 2013.

Patel attributed the drop mainly to the sale and removal of the personal property from the former GM Willow Run plant in Ypsilanti Township.

Most new construction in the past three years has been increasingly in downtown development authority districts where a portion of the taxable value is captured through a tax increment finance district, Patel said.

“This year is unusual because most new construction has happened in DDA districts,” Patel said.

In the City of Ann Arbor, the DDA and Brownfield districts will collect about $179.8 million from property taxes, according to Patel’s 2013 report.

The following is the estimated percent change in 2013 taxable value from the 2012 figure for each municipality:

Cities

- Ann Arbor: 3.34

- Chelsea: 0.52

- Milan: 3.51

- Saline: 3.97

- Ypsilanti: -0.38

Townships

- Ann Arbor: 0.18

- Augusta: -1.52

- Bridgewater: -0.89

- Dexter: 2.73

- Freedom: 5.07

- Lima: 3.51

- Lodi: 0.53

- Lyndon: 3.66

- Manchester: 0.64

- Northfield: 3.25

- Pittsfield: 0.32

- Salem: 1.62

- Saline: 3.88

- Scio: 1.30

- Sharon: -1.20

- Superior: 0.36

- Sylvan: -0.48

- Webster: 2.90

- York: 3.82

- Ypsilanti: -2.53

Amy Biolchini covers Washtenaw County, health and environmental issues for AnnArbor.com. Reach her at (734) 623-2552, amybiolchini@annarbor.com or on Twitter.

Comments

Belgium

Thu, Apr 18, 2013 : 6:09 p.m.

Property values would be increasing faster if appraisers weren't afraid to give an fair value. Many are being sued by banks for high valuations during the crazy days of 2008'ish. I've had three appraisals and the high and low were almost 60% different.

ahi

Thu, Apr 18, 2013 : 5:42 p.m.

Considering the projections for the city of Ypsilanti, -0.38 is very good news.

Dog Guy

Thu, Apr 18, 2013 : 1:17 p.m.

Our Washtenaw County urban property tax assessors are objects of envy in the creative arts world.

Duc d'Escargot

Thu, Apr 18, 2013 : 12:43 p.m.

We wait with bated breath for someone to complete the already long, yet incomplete sentence that is the photo caption.

Amy Biolchini

Thu, Apr 18, 2013 : 3:11 p.m.

You can breathe easy now. I've fixed the sentence.

Basic Bob

Thu, Apr 18, 2013 : 11:39 a.m.

this is a great thing if you have a tif deal. taxes go up, not because of the reinvestment but because of the overall economy. this will help pay for the state road widening and the 3 new roundabouts. not to mention it will make the runway relocation and expansion necessary. is annarbor.com covering the state road corridor improvement authority?